What Is Zip?

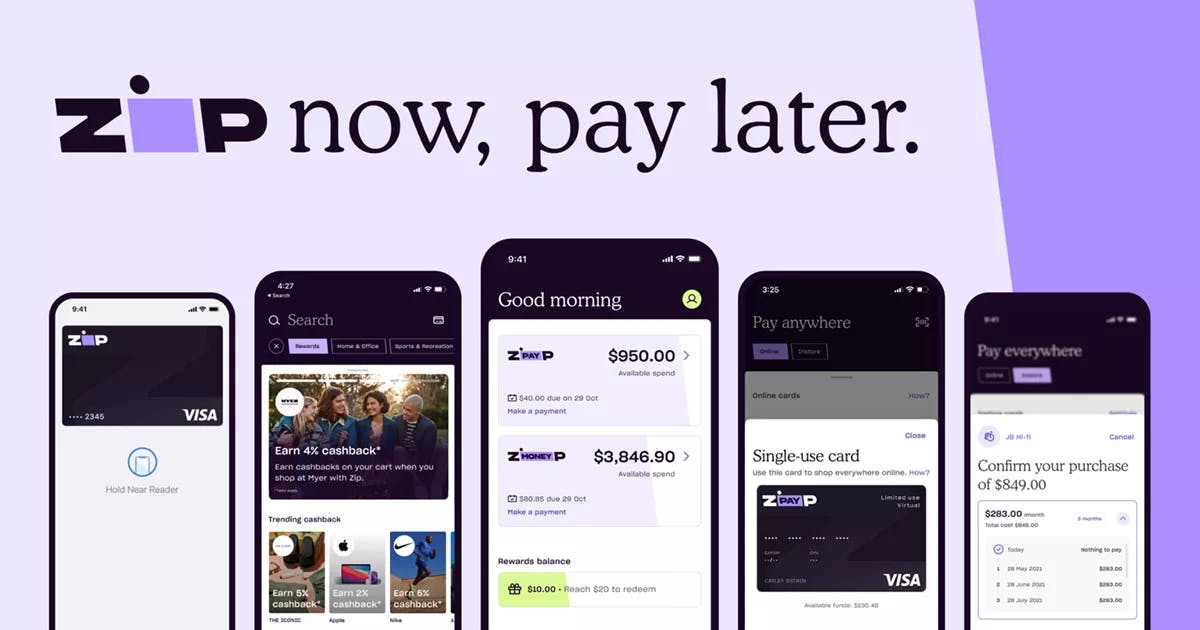

Zip is a Buy Now Pay Later (BNPL) service provider. With Zip, you can split a purchase into four equal installments to be paid over several weeks. The service can be used either online or in-store.

BNPL services have exploded in popularity in recent years, allowing consumers to make purchases with a form of short-term credit, pay over time rather than immediately, with basically no credit implications when used responsibly.

Australia-based BNPL provider Zip was founded in 2013 and acquired Quadpay, a US-based payment installment platform, in 2020. With the merger, the companies were able to reach more than 3.5 million customers and 26,000 merchants around the world combined.

Similar companies include Affirm, Afterpay, and Klarna.

How Does Zip Work?

Zip offers a standard pay-in-four installment plan. When you select Zip at checkout, you can make a purchase immediately. That purchase will be divided into four equal installments, with the first payment due at checkout. The remaining balance will be divided over the next six weeks.

Zip is promoted as interest fee, but you will be charged a $1 convenience fee per installment. The company also charges a late fee between $7–$10, depending on your state of residence, if you miss a payment.

Here’s how Zip’s payment plan works. If you make a $100 purchase, you will owe $26 ($25 plus $1 convenience fee) at checkout. The remaining balance of $75 will be divided into three equal installments of $26 to be paid every other week.

When you pay with Zip, you are automatically enrolled in autopay, meaning that each installment will be charged to your original method of payment every two weeks.

However, if you find that you are not able to make a payment on time, you can change your payment date at least 24 hours before it is due to align with your cash flow. The payment can be made up to 7 days late without penalty. When you move a payment date, future payment dates will also be adjusted.

If you do have to move a payment date, Zip will place a hold on your account so you cannot make any new purchases until your account is up to date.

Pros and Cons of Using Zip

There are a number of advantages and disadvantages to using Zip.

Pros of Using Zip

- Interest-free payment option

- Soft credit check approval process won’t damage your credit score

- Can be used anywhere Visa is accepted

- Ability to reschedule installments

Cons of Using Zip

- Convenience fee with each installment

- Late fees if you miss a payment

- Potential credit score damage for missed payments

Should You Use Zip?

There are many different reasons why you may want to use Zip as a Buy Now Pay Later solution. However, the decision should not be made lightly.

Using Zip requires you to know on a personal level how you manage your money, whether you are in the right financial position to take on credit, and whether you are able to avoid the temptation that comes with Buy Now Pay Later.

You might want to use Zip if

You want or need to purchase a big-ticket item

A guitar, lift tickets at your favorite ski resort, tires, or accommodations for your next trip. Expenses pop up, and if you do not have the money in your checking or savings account, sometimes there is no choice but to put it on credit. Zip gives you an extra financing option without the interest. Just make sure that you’ll be able to pay off your installments when they roll around or you could end up with credit score damage.

You do not qualify for a credit card or have a credit card with a low limit

Zip affords you the opportunity to make purchases with credit even if you do not have the money in your account right this moment.

However, it is important to only make purchases with Buy Now Pay Later if you are certain that you will be able to pay off the installments when Zip direct debits your account. Missing a Buy Now Pay Later payment can result in a late fee and damage to your credit score.

You might not want to use Zip if

You are trying to build credit

Buy Now Pay Later is not a traditional form of credit. Zip, unlike a credit card company, does not report on-time payments to the credit bureaus. It only reports missing or late payments. This means that Buy Now Pay Later cannot help you — it can only hurt you.

You have a tendency to overspend or can’t avoid the temptation

This requires a long, hard look in the mirror. The fact of the matter is that it’s easier than ever to want things that you see online — and then to turn those wants into purchases. Buy Now Pay Later makes that even easier.

Where Can You Use Zip?

You can pay with Zip at more than 50,000 retailers around the world. In fact, you can use Zip anywhere that accepts Visa. The company partners with brands focusing on electronics, fitness, beauty and health, clothing and accessories, flights, hotels, and education.

Popular brands that accept Zip include:

- Best Buy

- Clear

- Airbnb

- Liftopia

- Away

- Guitar Center

- Goodyear

- Sam’s Club

- World Market

- Revolve

Does Zip Hurt Your Credit Score?

Many creditors perform a hard inquiry on your credit report to determine your creditworthiness before issuing you a loan or credit card.

Zip is considered a short-term financing option, so the company does not perform a hard inquiry on your credit. The company does, however, run a soft credit check to determine if you are eligible to receive financing, but the check does not hurt your credit score.

Once you’ve made your purchase, you must make on-time payments. If you miss payments, you may incur a late fee and Zip can report your missed payments to the credit bureaus. This can bring down your credit score and hurt your chances of getting approved for financing by Zip and other lenders in the future.

Alternatives to Zip

Zip works much like other Buy Now Pay Later services including Affirm, Afterpay, Klarna, and Sezzle. The BNPL solution that you use often depends on which one is offered by the merchant.

However, if you do not want to use Zip, there are other options.

Personal loan

For more expensive purchases, you may want to take out a personal loan rather than using Buy Now Pay Later. It’s definitely not the right choice or accessible to everyone. However, it can enable you to make a large purchase and pay it back over a longer period of time with relatively little negative consequences if you’re responsible with your payments.

Similar to a credit card, a lender will run a hard inquiry on your credit to determine whether you are eligible for the loan. This credit check can temporarily decrease your credit score. But also similar to a credit card, a personal loan can help you boost your credit score in the long term as long as you make on-time payments.

Buy Now Pay Later won’t afford you that opportunity.

When taking out a personal loan, it’s important to find the lowest possible interest rate. You should also make sure that you have a payment plan in place to avoid late fees and credit score damage.

0% interest credit card

For less expensive purchases, a 0% interest credit card may be the way to go depending on how you plan to utiltize the credit in the future. This is considering that you qualify for the credit card.

You should also note that the credit card company will likely do a hard inquiry on your credit report before approving you for the card. This can cause a temporary decrease in your credit score.

When you apply for a credit card, even if it is 0% interest, you should be sure that you can make on-time payments in order to avoid credit score damage.

A credit card can be optimal if you want to take advantage of an introductory offer, earn rewards for your purchase, or boost your credit score, which you cannot do with Buy Now Pay Later.