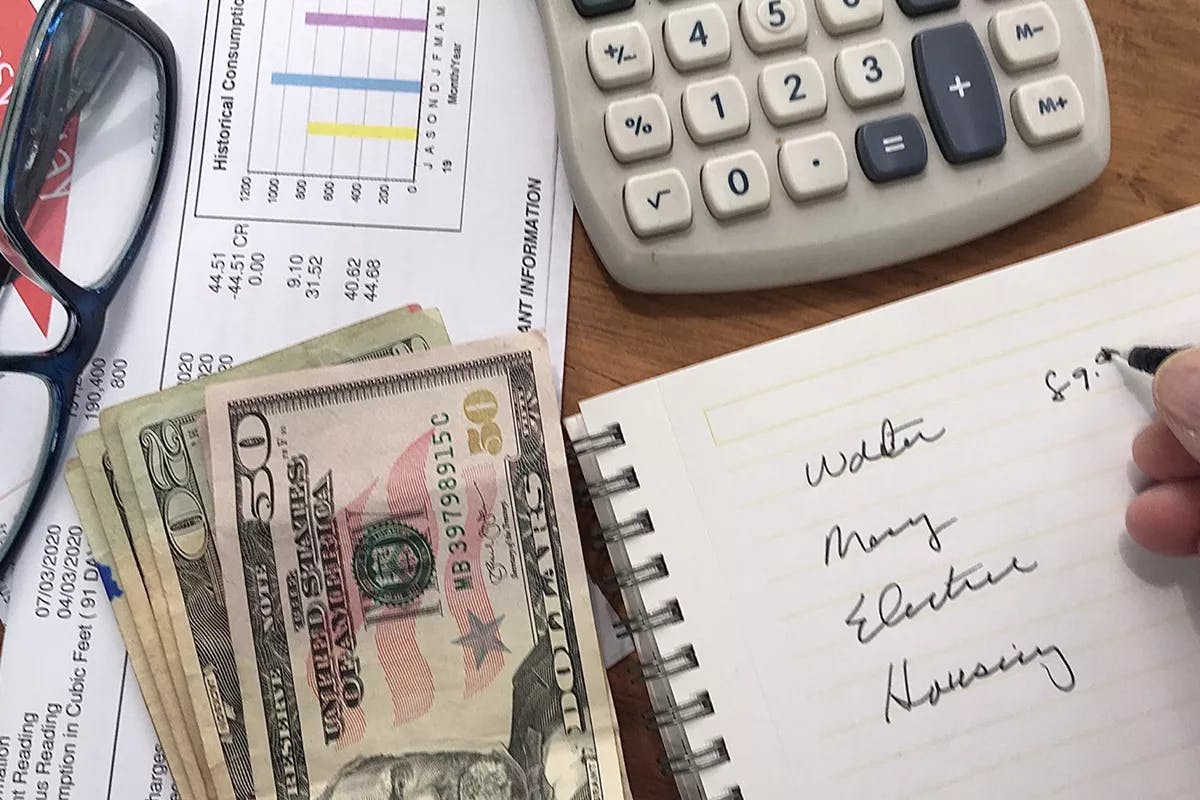

For many people during the COVID-19 pandemic, paying essential bills became a game of “what’s more important?” — rent or medical bills, groceries or utilities, credit card payment or child care.

A recent report indicates that Americans pay roughly $2.75 trillion annually on recurring bills, such as mortgage and rent, utilities, cable, internet, and insurance. An average of $21,378 per household — or one third of Americans’ annual income — goes toward these common bills, which don’t even include food or gas to make your car run.

When it comes down to it, the cost to keep your head above water can feel insurmountable, even when you’re not in the throes of a global pandemic. While creating a budget might not solve every problem, it’s a great first step toward financial stability and wellness.

Before creating a budget, you have to prioritize your expenses, or determine which areas of spending make the most sense for your needs. Just as your income and lifestyle looks different from your neighbor’s, so will your process of prioritizing your expenses.

Here are a few categories of spending that you should be focusing on in roughly the order that you should prioritize them.

1. Bills

Essential, recurring expenses that you can expect to pay on a monthly or regular basis include housing, utilities, transportation, cable and internet, insurance, and child care.

Housing

One of the most common recurring expenses, whether you rent or own. You can try to downsize or minimize housing costs, but this is not an area you should skip altogether.

Utilities

Can include electricity, heat, air conditioning, water, gas, trash collection and sewer, and sometimes cable and internet. If you rent, these costs may be included in how much you owe your landlord each month. For homeowners and other renters, you may have to source and pay for these services independently. This can be beneficial so you can shop around for the cheapest option, but it can also be problematic since that’s one (or several) more bills that you have to keep track of each month.

Utilities vary from place to place, but according to Move.org, average household utilities cost $398.24 per month.

Transportation

A car payment or frequent public transportation expenses. Whether you live in a city, suburb, or rural area, chances are you’ll need some form of transportation to help you get around — to work, the grocery store, the doctor, or elsewhere.

According to Experian, the average monthly payment for a new vehicle is $554, or $391 for a used vehicle. Public transportation costs can be a fraction of the price, even in the most expensive U.S. cities such as Los Angeles and New York, but public transit can also have stricter hours and limit how far you’re able to travel.

Cable and internet

At one time, cable and internet would’ve been considered leisure expenses. Today, most things, including work, have gone virtual. It’s now very common for cable and internet to be a mandatory expense in households.

For renters, these two may be lumped in with utilities bills. Separately, utilities cost $85 per month on average while internet bills hover around $60, according to Move.org.

Insurance

It is important to invest in health, car, homeowners, or renters insurance, if necessary. Accidents happen; it’s usually more cost effective to dedicate a certain portion of each paycheck to these expenses than pay for an accident out of pocket and all at once.

Child care

Like most things, the cost of child care can vary from person to person, or you may not have to pay it at all. In a recent Cost of Care survey by Care.com, child care has reportedly increased significantly over the past six years. Of survey respondents, 55% of families say they spend at least $10,000 on child care annually, and 72% say at least 10% of their household income goes toward child care.

If you’re a working parent with a child, it can be difficult to do away with this expense entirely, but there are ways to reduce it. Look for alternative child care options in your area, ask your employer if they offer child care benefits, or see if your state offers subsidies for your situation.

2. Necessary Expenses that Vary

There are bills that pop up in your mailbox once a month, but there are equally as important costs that don’t come with a recurring bill.

Food

This expense should be one of your top priorities. Food is the fuel that keeps your body and mind healthy. Without sustenance, you could become ill, causing you to miss work and miss out on money that pays the bills. As important as food is, it can also be one of the easiest areas to cut down on. Base simple meals around on-sale products, use a grocery list, meal prep, and minimize eating out.

Supplemental transportation

Although a car payment or frequent public transportation usage can be considered a mandatory expense, there are certain aspects of transportation that are variable — gas, for instance. You’ll have to factor gas into your priorities, but like food, there are a few ways to cut down on the cost. If you live in an easily navigable area, consider walking, biking, carpooling, or scheduling your week to minimize gas usage.

3. Savings

If you have debt, it can be difficult to decide whether you should prioritize saving your money or paying off your debts first. In actuality, you should be building some of your savings as well as paying down debt at the same time. When it comes to saving, there are a couple events in life that you should prioritize putting away money for.

Retirement

Many people put off saving for retirement because they assume it’s a long way off and therefore not important at the moment. In actuality, it’s critical that you begin saving for retirement as soon as possible. Most people will have little to no income once they retire, meaning you’re meant to live off of the income that you start setting aside now.

There are a number of things that factor into how much you should save for retirement, including age and desired lifestyle, but AARP suggests you should plan to set aside 80% of your pre-retirement income. Some employers offer 401k plans with competitive match programs. If yours does not, consider opening a Roth IRA or some other form of retirement account to kickstart your retirement savings journey.

Recommended article: How Much Do I Need to Retire at 55?

Emergency savings

Unfortunately, insurance doesn’t always cover expenses in emergency situations. When this happens, bills can pile up, but savings can help you out of a bind. The average ER visit for someone without insurance can cost anywhere from $150–$3,000. Coming out of pocket, that can put a big dent in your budget and possibly set you back on a number of other expenses.

Emergency savings can also cover living costs, such as paying rent and utilities during a global pandemic. Your savings doesn’t have to be huge; after all, you’re also trying to pay the bills, save for retirement, and possibly pay off debt. You should aim to have at least three months worth of living expenses in an emergency savings account at any time.

4. Debts

Some aspects of paying off your debts may come before saving, some after. Which you prioritize is entirely dependent on your individual circumstances. At the very least, you should be making minimum payments on all of your debts each month.

If you have high-interest or time sensitive debts, try paying these off first. They typically include credit cards, balance transfers, and personal loans. Credit card issuers can promote balance transfer offers with competitive interest rates. However, after the introductory period, the interest rate may increase substantially, even higher than standard credit card interest rates, which average 16.13%. Personal loans, on the other hand, can come with slightly lower interest rates (9.41% on average, according to Experian).

When prioritizing your debts, there are several different methods for paying them off. Tackling the ones with the highest interest is one of the most common, as well as the most cost efficient. If you struggle with motivation, consider the snowball repayment method to knock out your smallest debts first.

Final Thoughts

Once you’ve dedicated money to your bills, essential costs, savings, and debts, you can begin allocating your money to other personal needs. This is called discretionary spending. Saving for a kitchen remodel or a week-long vacation? Looking to purchase a new pair of shoes? With your top priorities taken care of, it’s your call where your money goes next.

However, if you’ve found that you don’t have enough money to pay for even the most basic necessities, you might consider scaling back or completely eliminating costs that you originally thought you needed.