All your Buy Now Pay Later payments in one app

Your one-stop-shop to track and manage your BNPL payments with ease

Track PaymentsNo more jumping between apps

All your due dates, loan dates, and payments in one clean dashboard.

Cushion does all the work to organize your Buy Now Pay Later purchases and payments automatically

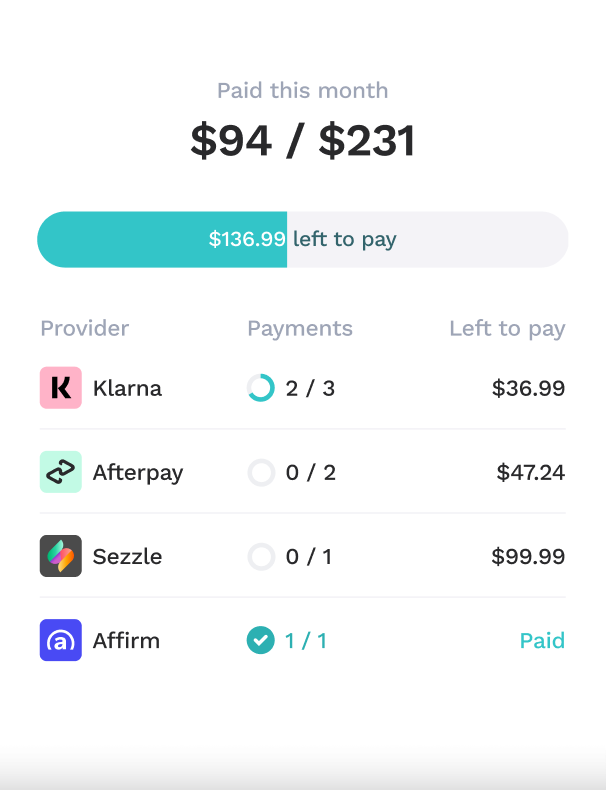

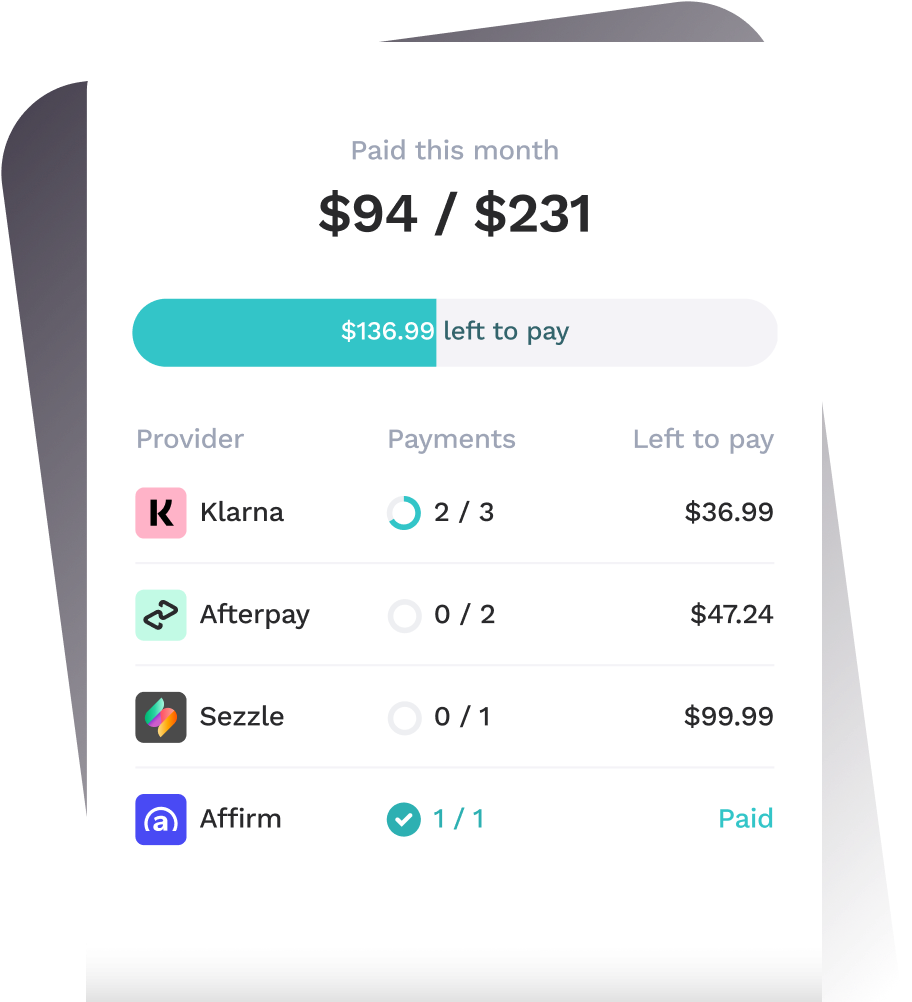

Overview

Get a quick snapshot of your progress for the month broken down by BNPL provider

01.

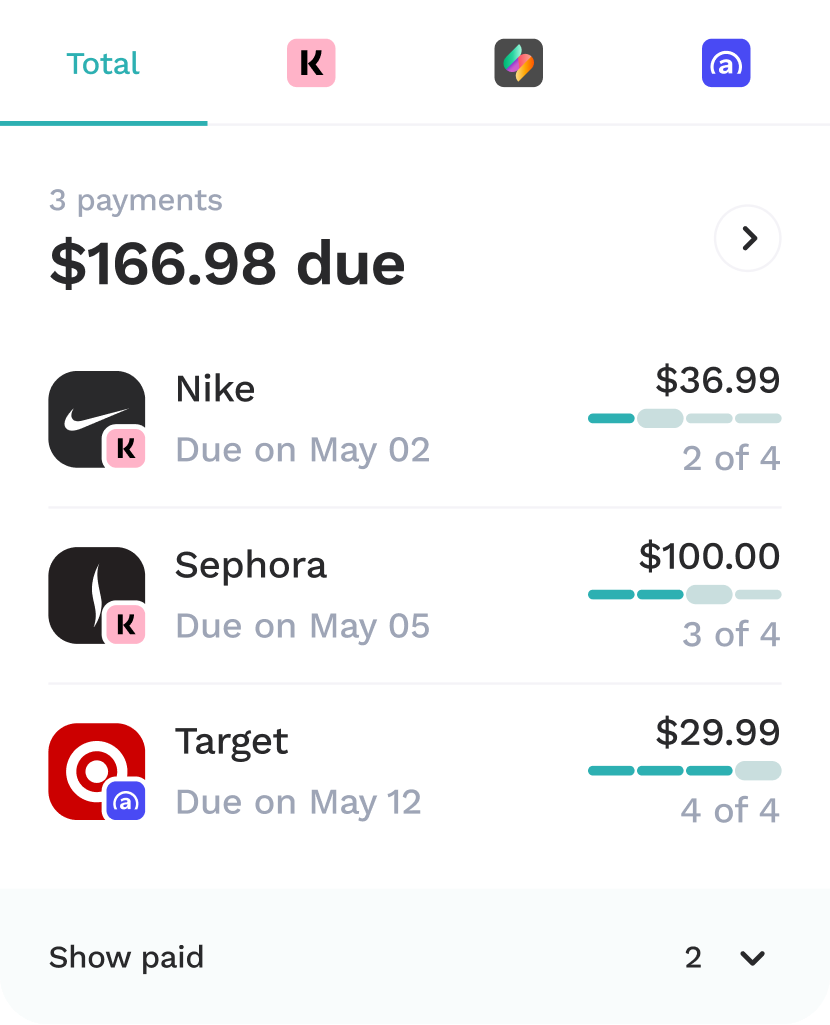

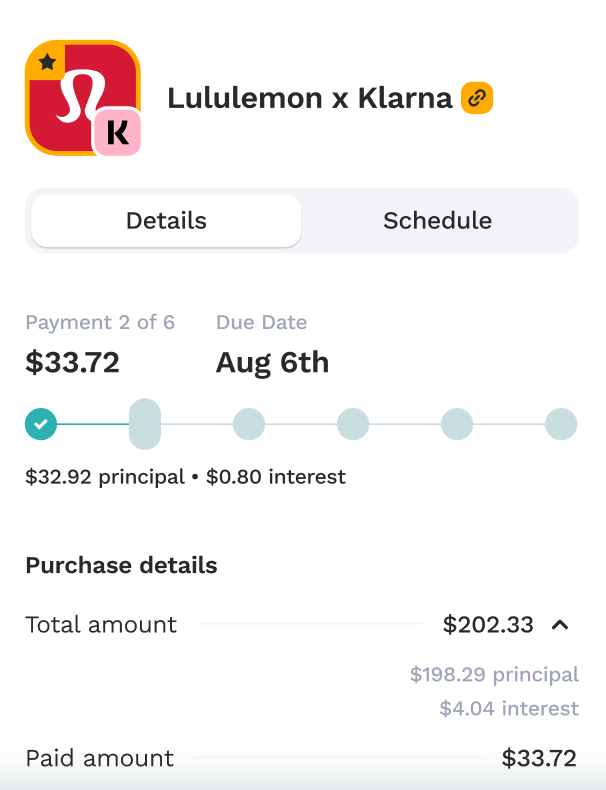

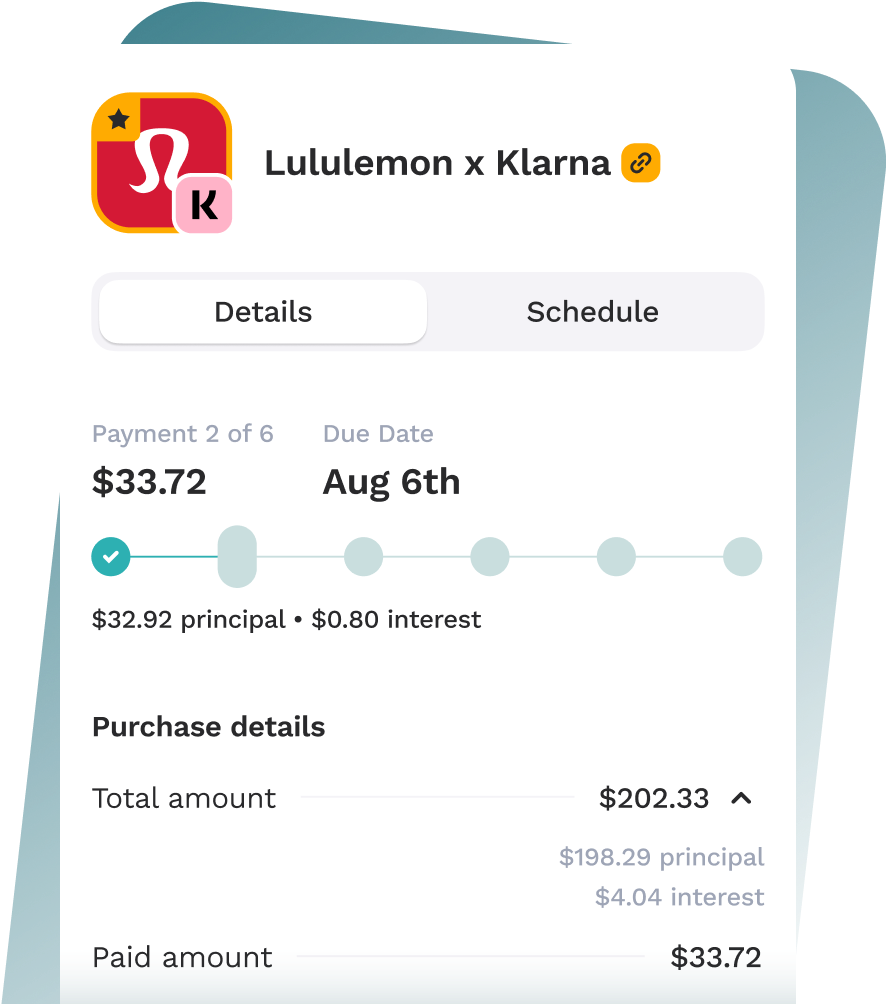

Loan Details

Go a level deeper to check your payment details, loan schedule, and more

02.

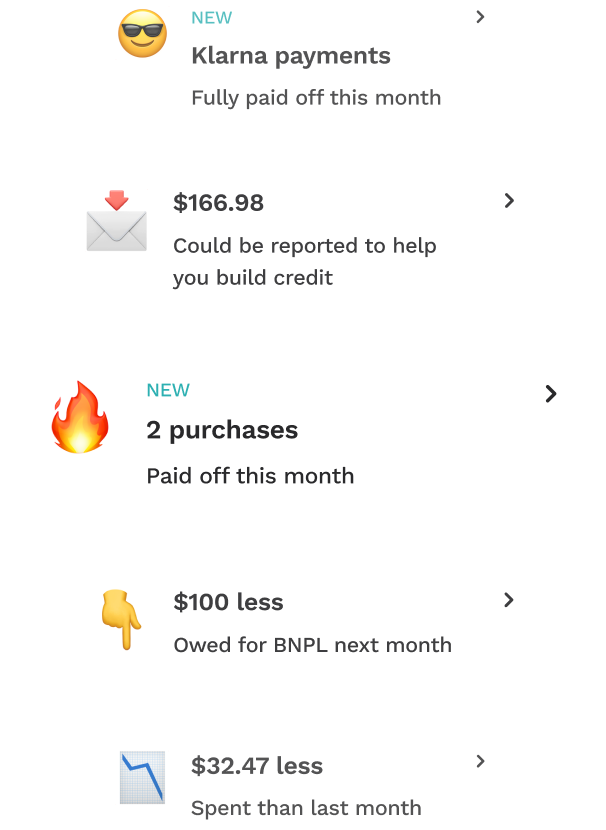

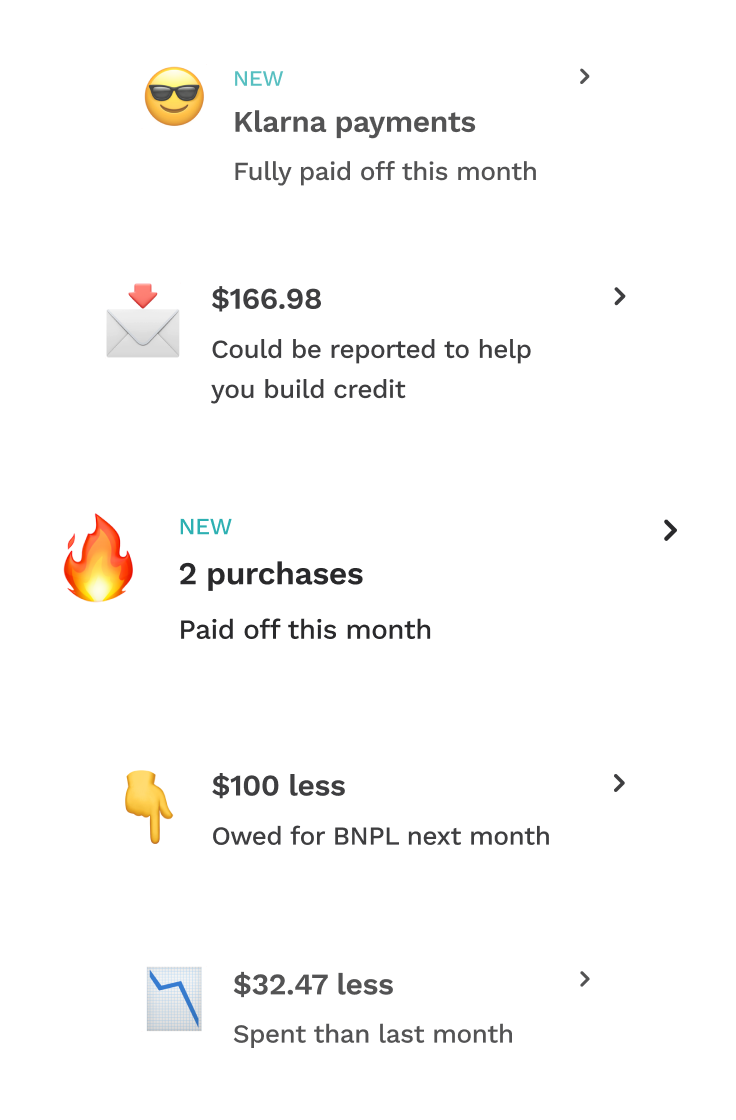

Insights

Review quick highlights of spend activity, recent loan payoffs, and trends

03.

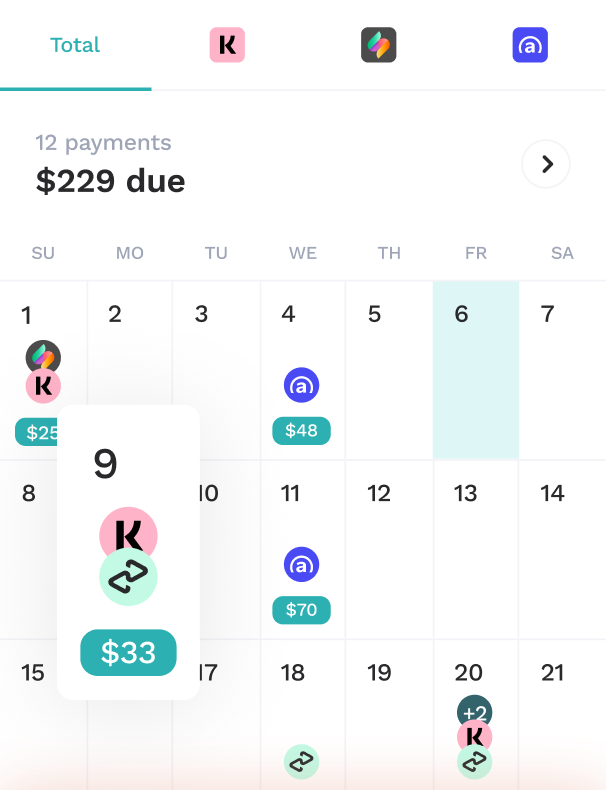

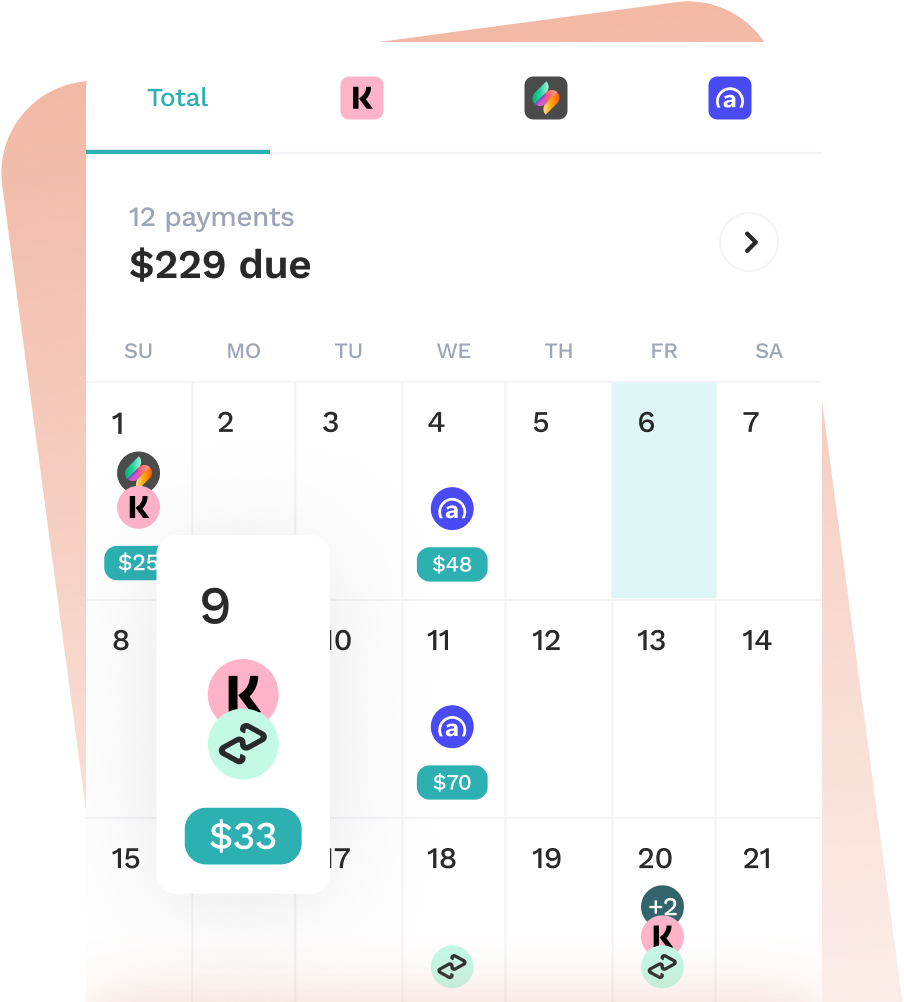

Calendar View

The quickest way to get a visual of your BNPL payments in a given month

04.

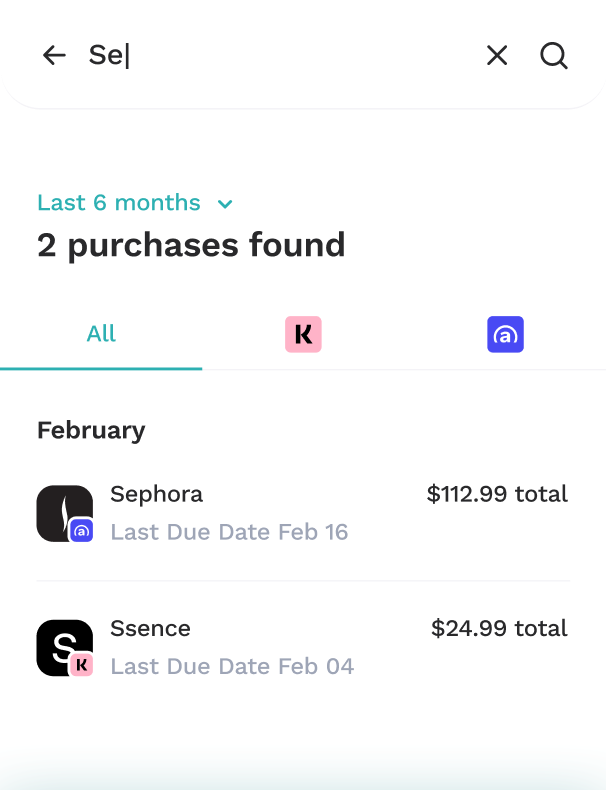

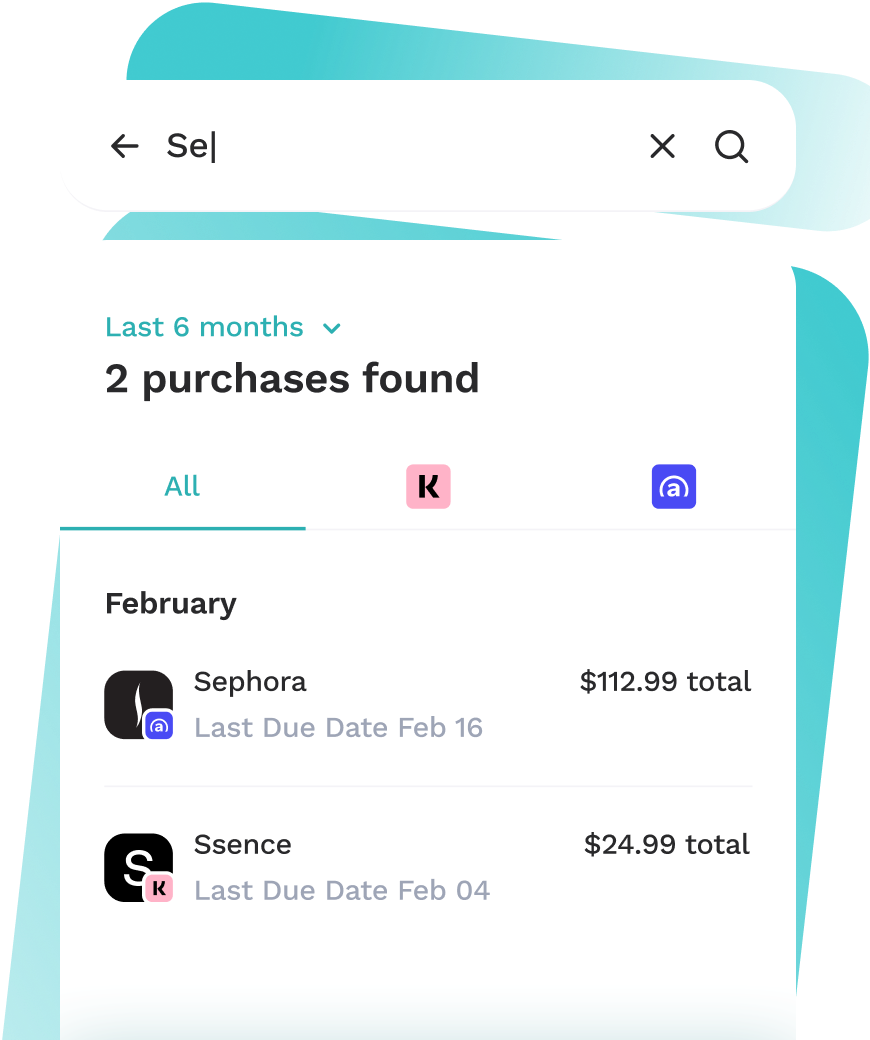

BNPL Search

Looking for something? Now you can search for any purchase across any BNPL provider

05.