Pay Bills, Build Credit 🚀

Get more out of your payments

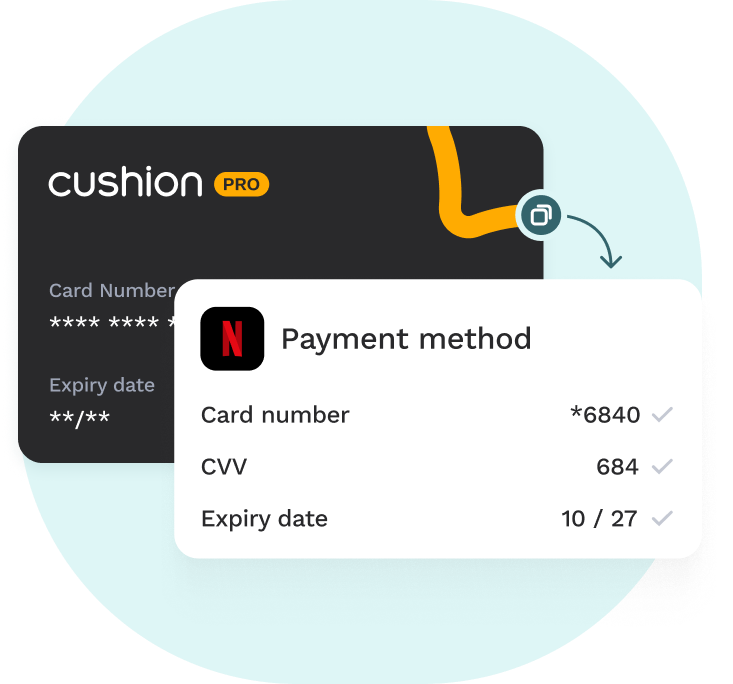

Pay with your virtual Cushion card

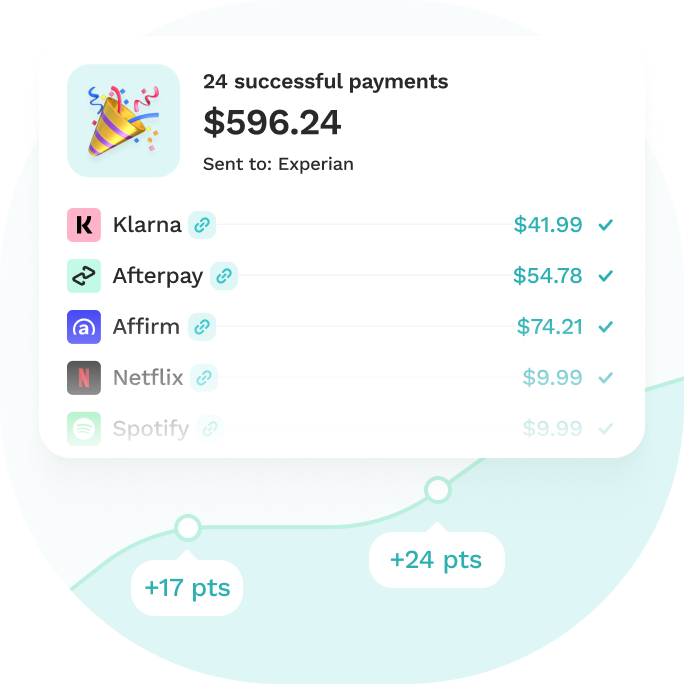

We report your payments monthly

Build credit with confidence

Turn Buy Now Pay Later and Bill Payments

How it works

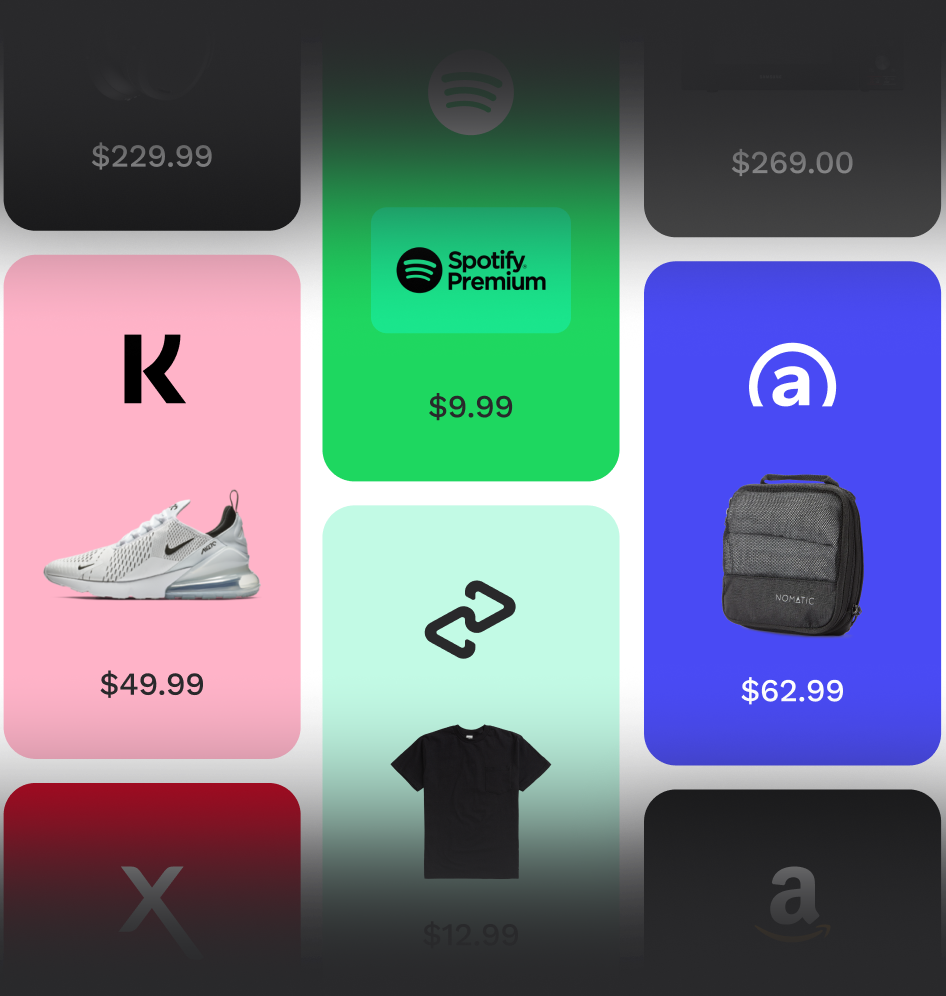

We organize your bills

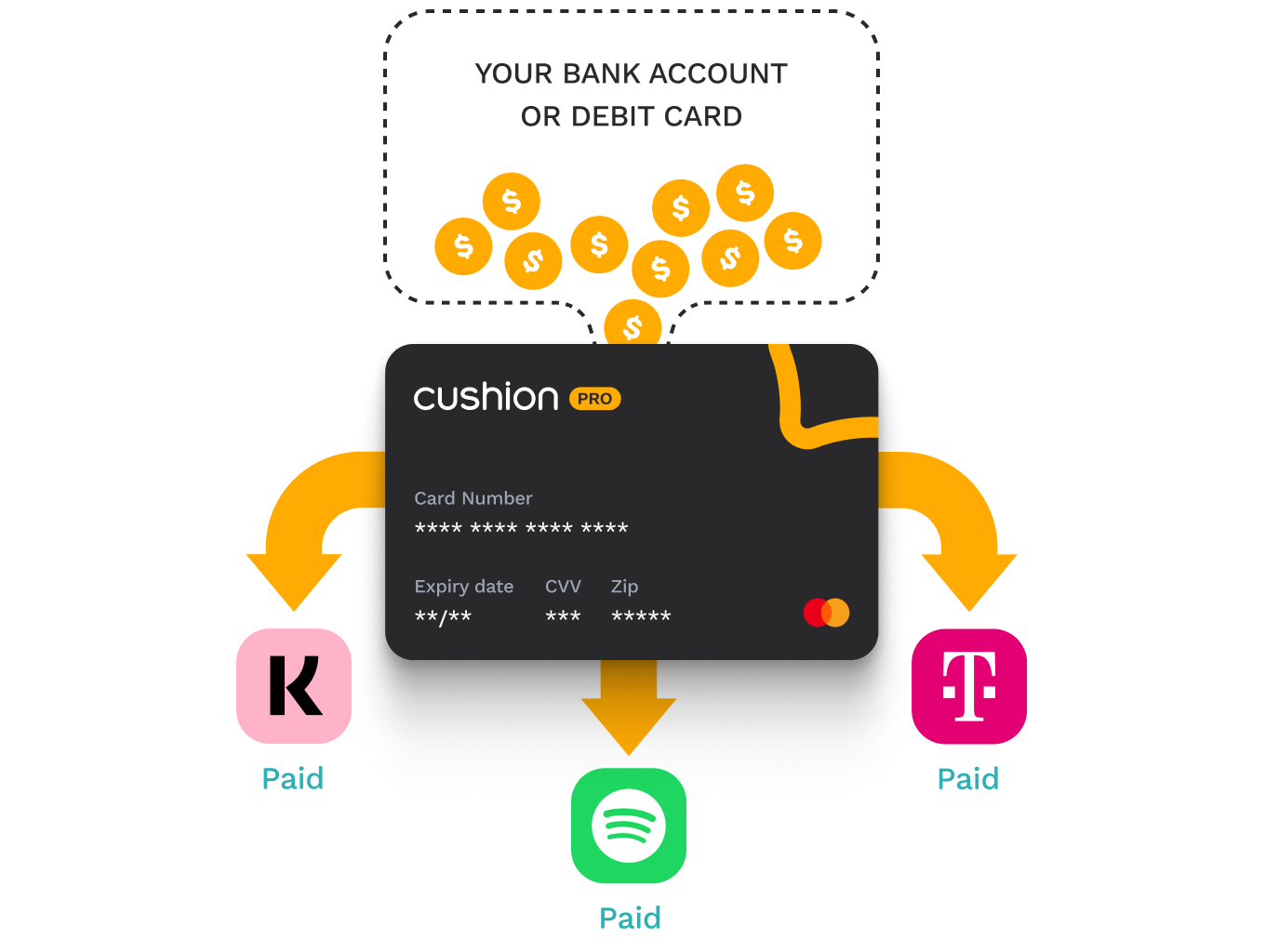

Activate your Cushion virtual debit card

Put it on file with billers

We report your payments to help you build credit

Our customers love us

FAQ

Securely connect your bank accounts, credit cards, and Gmail account to Cushion. We'll automatically find your bills, subscriptions, and Buy Now Pay Later purchases and add them to your Cushion account.

Track when your bills are due and pay them with your Cushion Card. Simply swap out your current payment method, replace it with your Cushion Card, and we will handle the rest.

We'll automatically make the bill payments on your behalf and then withdraw the bill amount from your bank account so long as you have sufficient funds in your bank account to cover the amount due.

Since Cushion is paying bills on your behalf and then pulling the funds from your bank account, this enables us to report your positive payment history to help you build credit.

On-time recurring payments build up positive payment history and can lead to an increase in your credit score over time.

When you use the Cushion card to pay your bills, we make bill payments on your behalf and then pay ourselves back. This allows us to report your bill payments as credit and demonstrate positive payment history to help you build credit.

There are many factors that go into calculating your credit score. How quickly you see an impact to your score will vary and depends on many factors. However, most of our users see an impact to their score within 3 months of signing up.

A positive payment history is one of the most influential components of your credit score. Paying your bills with the Cushion card every month will help you build a positive payment history over time and, ultimately, a better credit score.

It depends on when you sign up and make the first payment using your Cushion Card. Cushion reports all payments at the end of each month, starting with the first month in which you make a payment with your Cushion Card. After that, it can take up to 2 weeks to be processed by the credit bureaus and added to your credit report.

For information on how to view your credit report, check out this article.

There are many factors that impact your score and adding a new line of credit to your credit profile may cause a minor, temporary dip in your credit score because it may reduce the overall age of your credit history.

However, as you make on-time payments with your Cushion Card your credit score should rebound quickly and continue to build over time.

Check out the rest of our Credit Building FAQs.