Simplify Bills, Build Credit 🚀

Bills suck. We get it. That's why Cushion is here to make paying them and building your credit history surprisingly painless

Get started

Organize your bills with a few clicks

Securely connect your accounts to Cushion, and our AI will automatically find and organize all of your bills.

See all your bills & BNPL in one place

Track what's been paid or due next

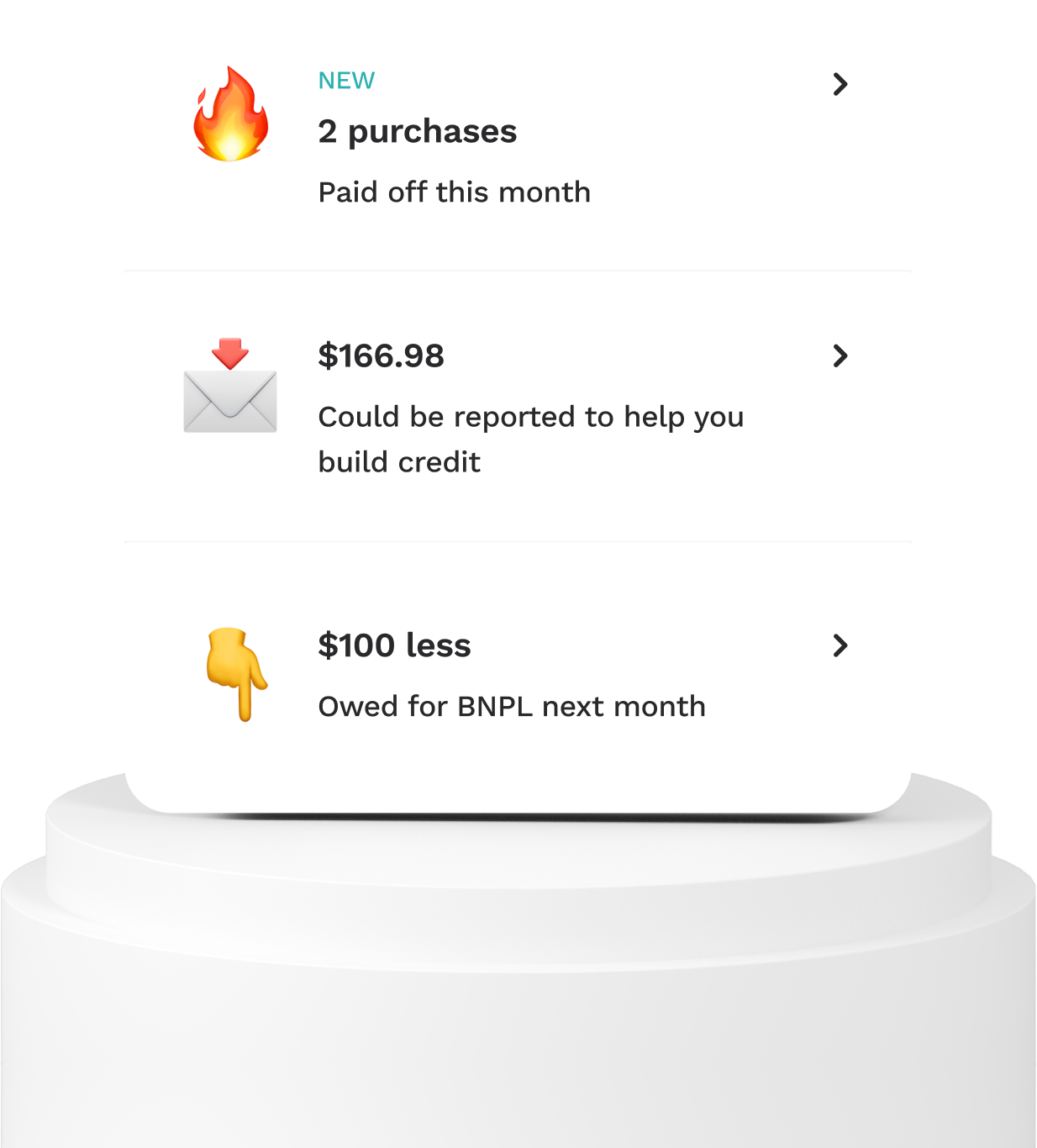

Get more insights and budget better

Pay your bills seamlessly while building credit history

Turn Buy Now Pay Later Payments

into credit building opportunities

Features

Organize your bills & BNPL automatically

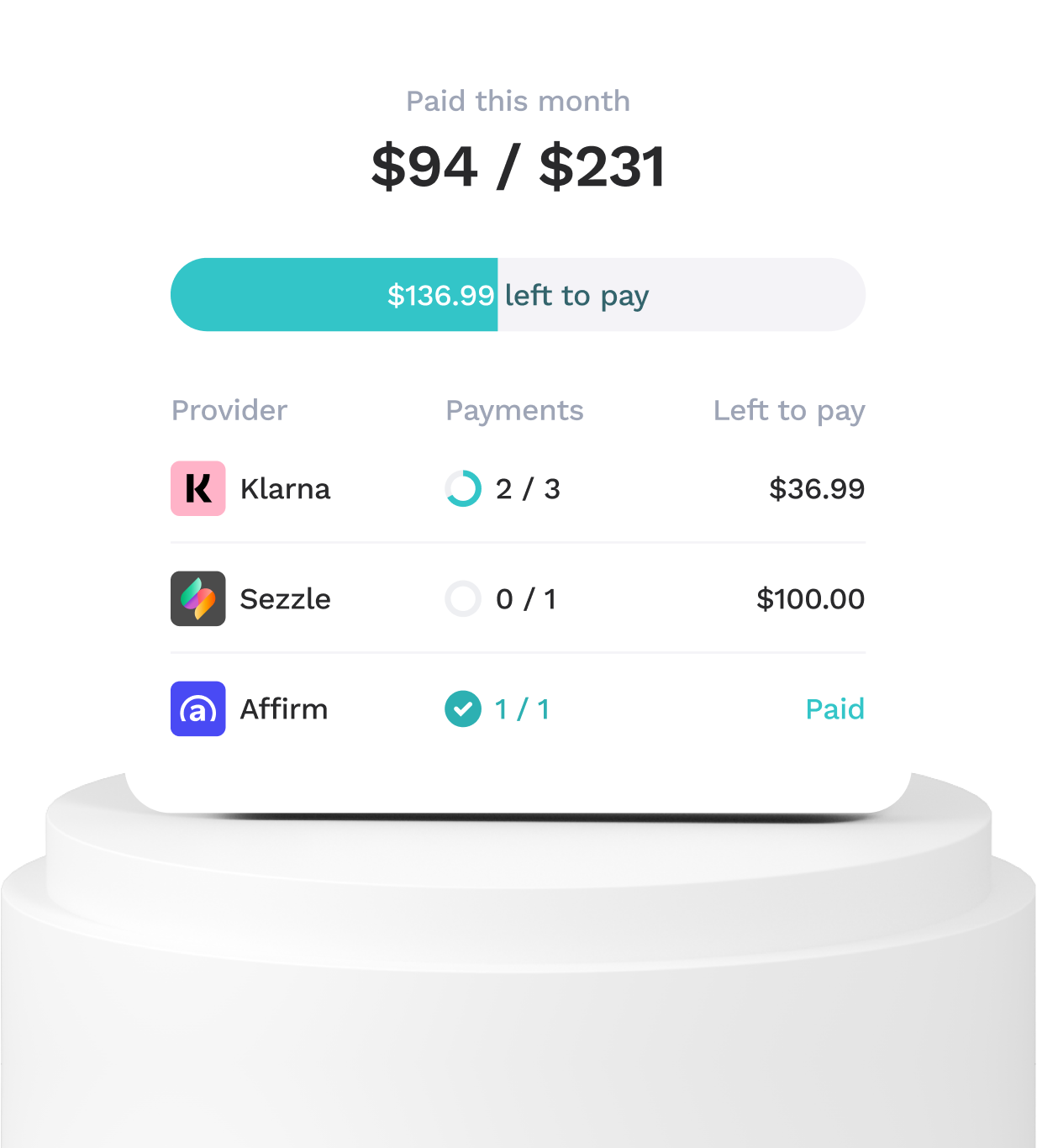

Track your bill & BNPL payment progress automatically

Make payments using your virtual Cushion card

Build Credit History with BNPL Payments

Build credit history with subscriptions, utilities, and more

Track your credit score (coming soon)

Split bills with roommates/partners (coming soon)

Turn Buy Now Pay Later and Bill Payments

into credit building opportunities

Features

Organize your bills & BNPL automatically

Track your bill & BNPL payment progress automatically

Make payments using your virtual Cushion card

Build Credit History with BNPL Payments

Build credit history with subscriptions, utilities, and more

Track your credit score (coming soon)

Split bills with roommates/partners (coming soon)

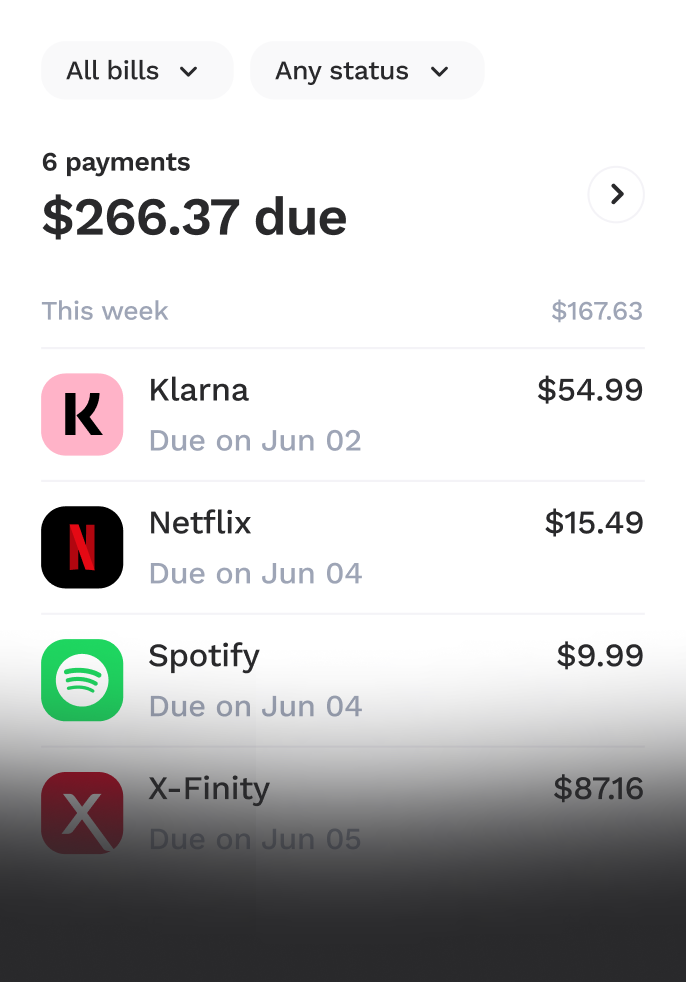

How it works

Step 1

We organize your bills

Securely link your bank and email. We'll find and neatly organize your bills and BNPL payments

256-bit SSL encryption

Top-tier security partnerships

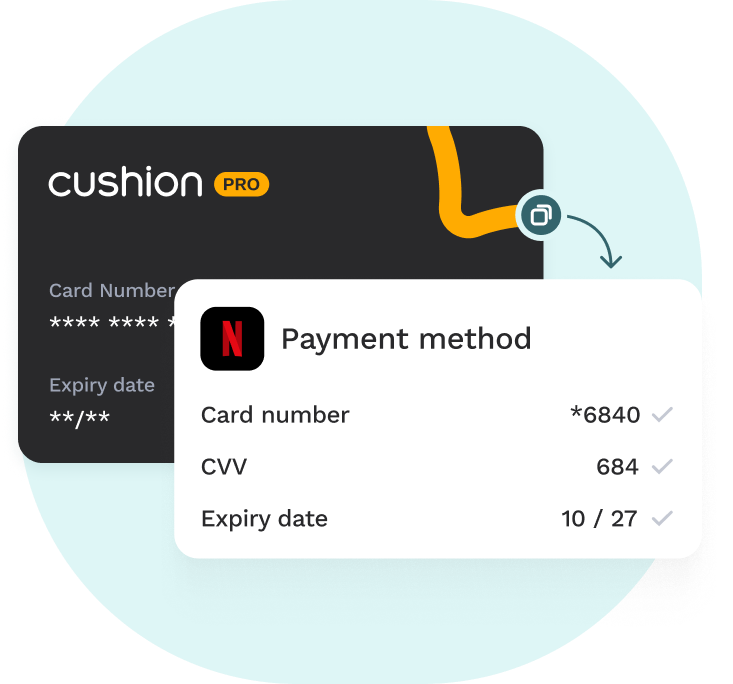

Step 2

Activate your Cushion virtual card

Choose one of the two virtual Cushion cards that best suits your needs

Step 3

Put it on file with billers

Set your Cushion card as the primary payment method with billers you pay regularly

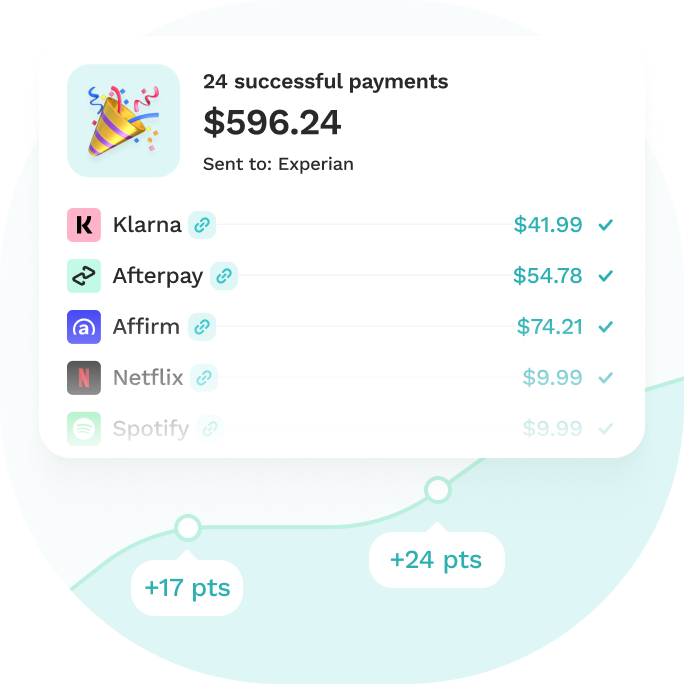

Step 4

We report your payments to help you build credit

Bills paid with a Cushion card are automatically reported to the credit bureaus

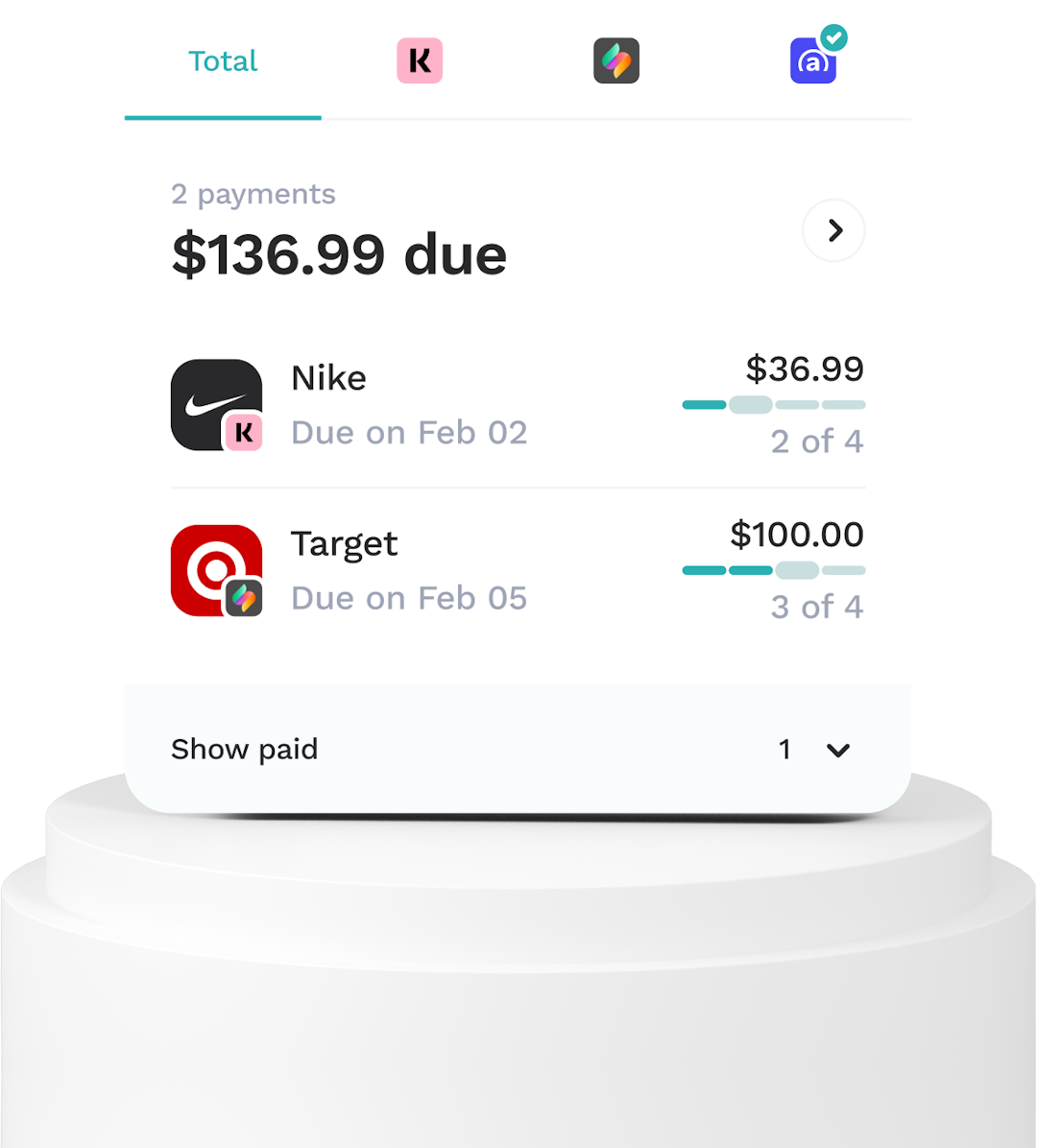

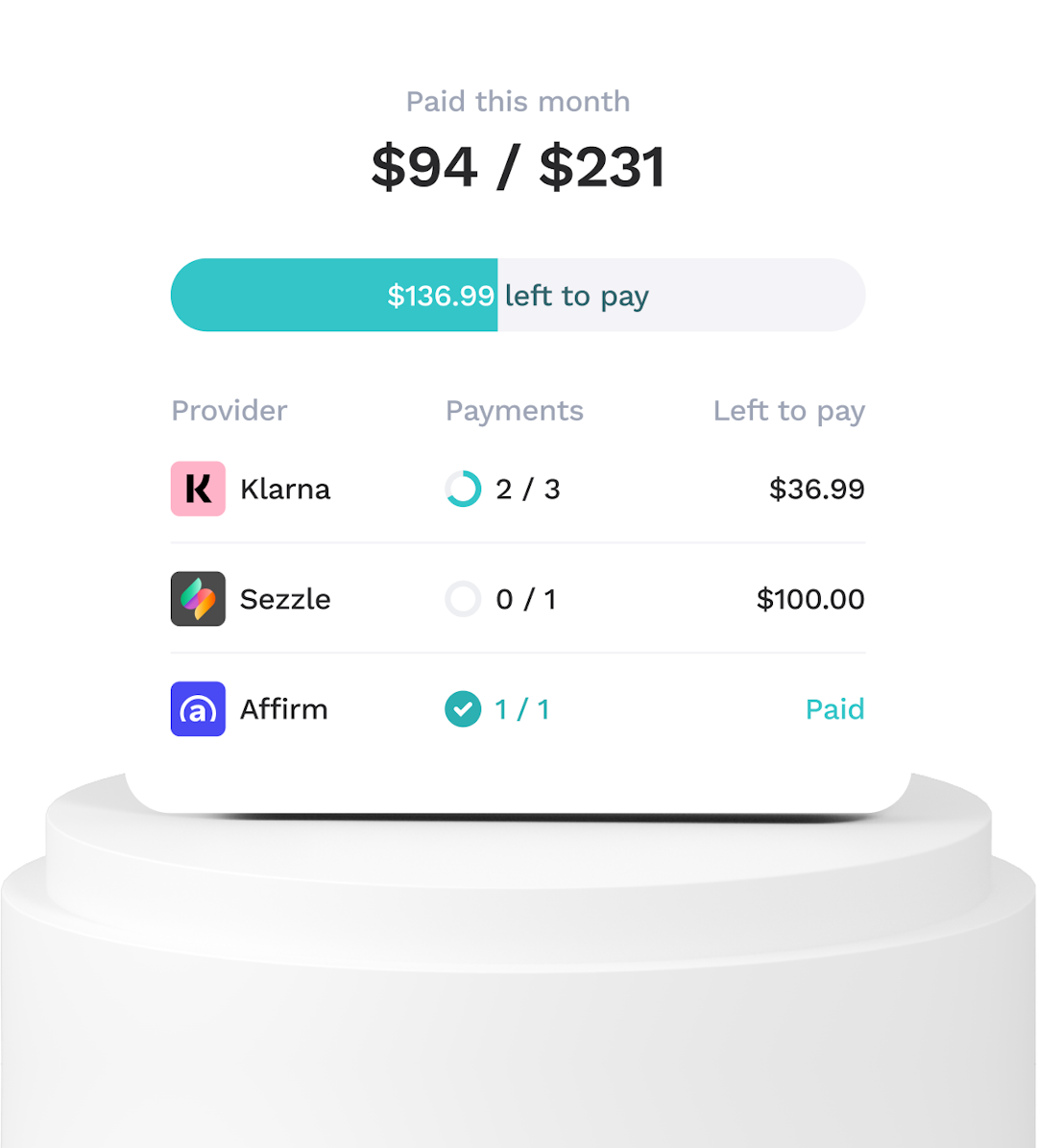

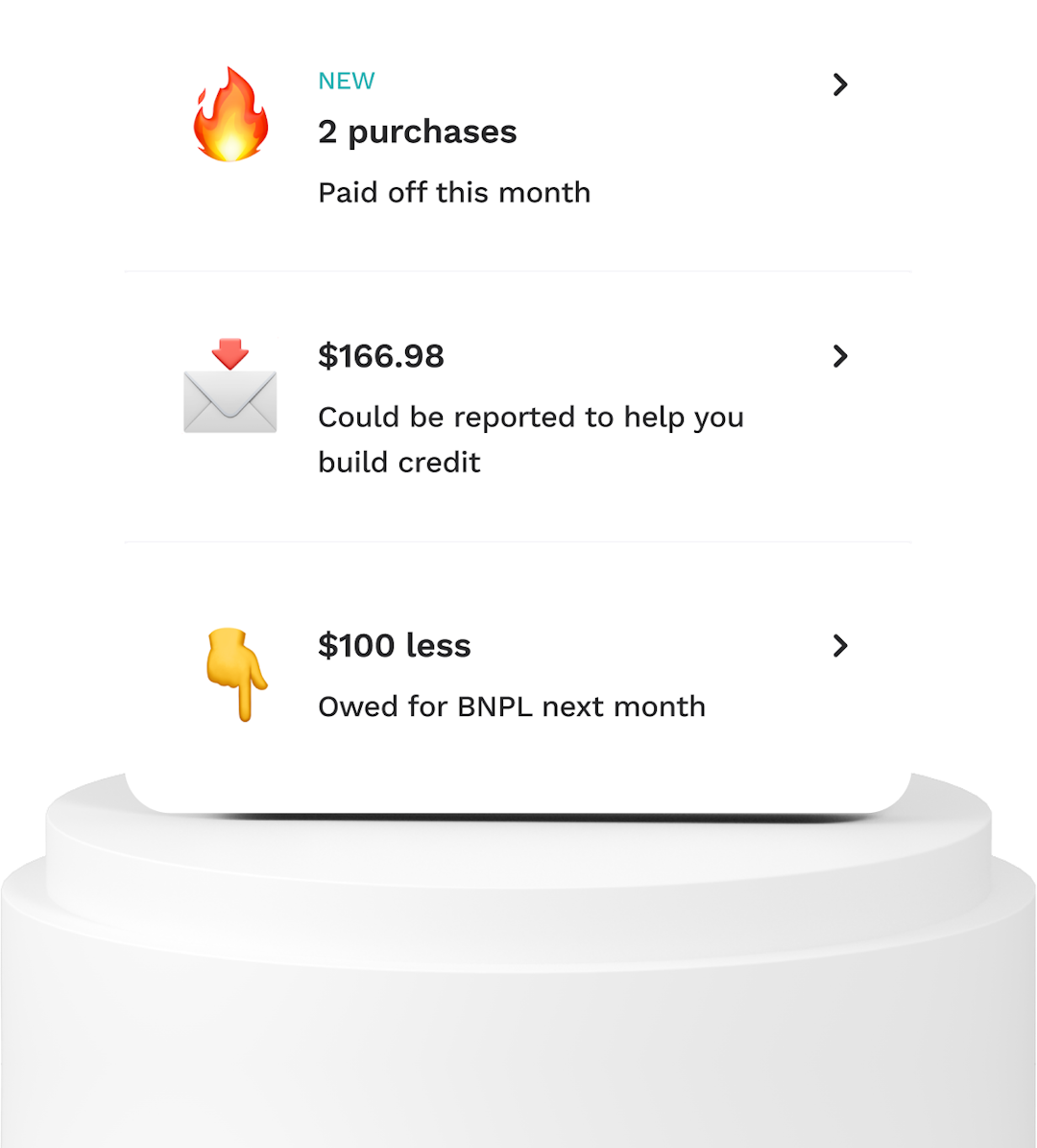

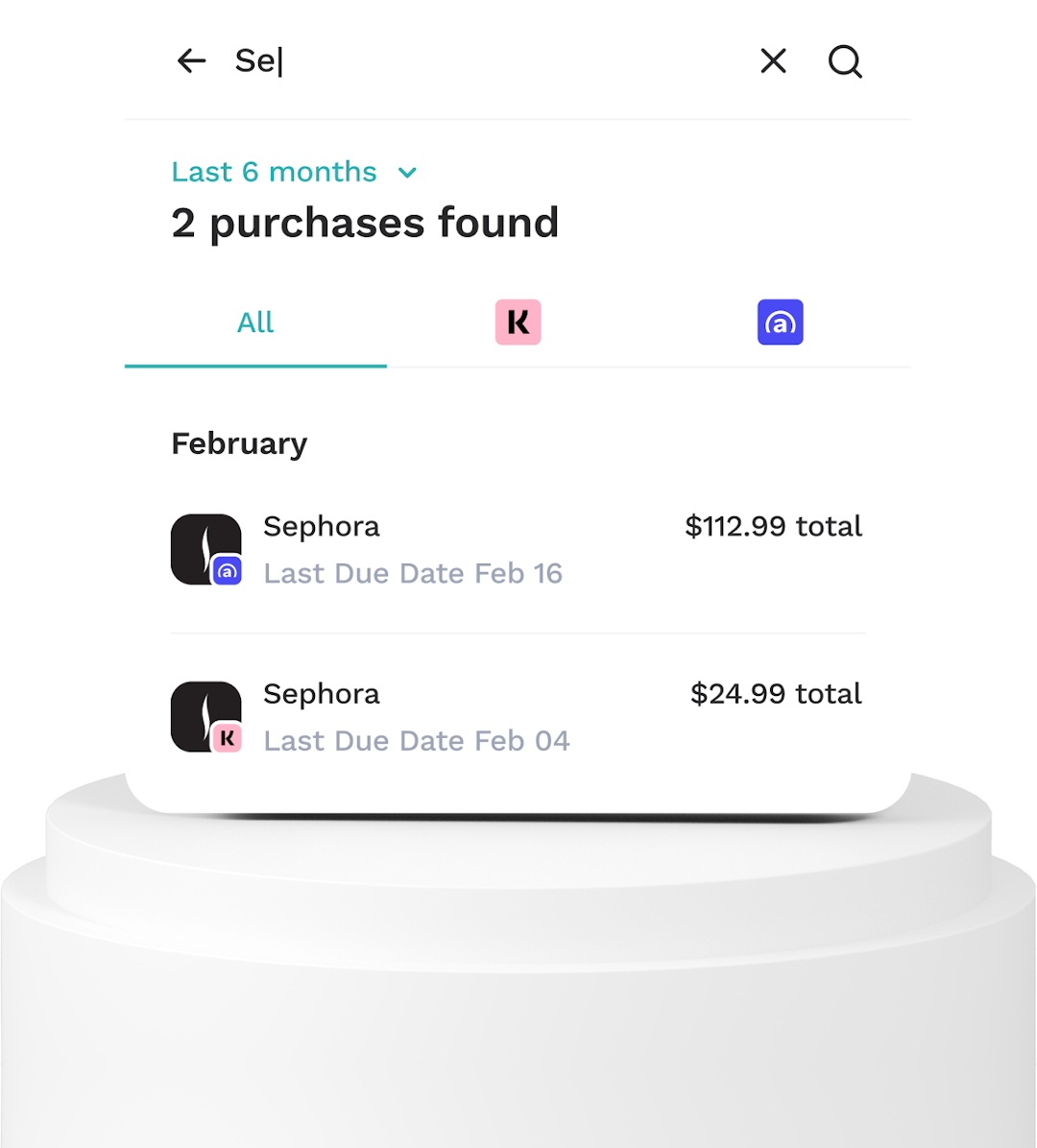

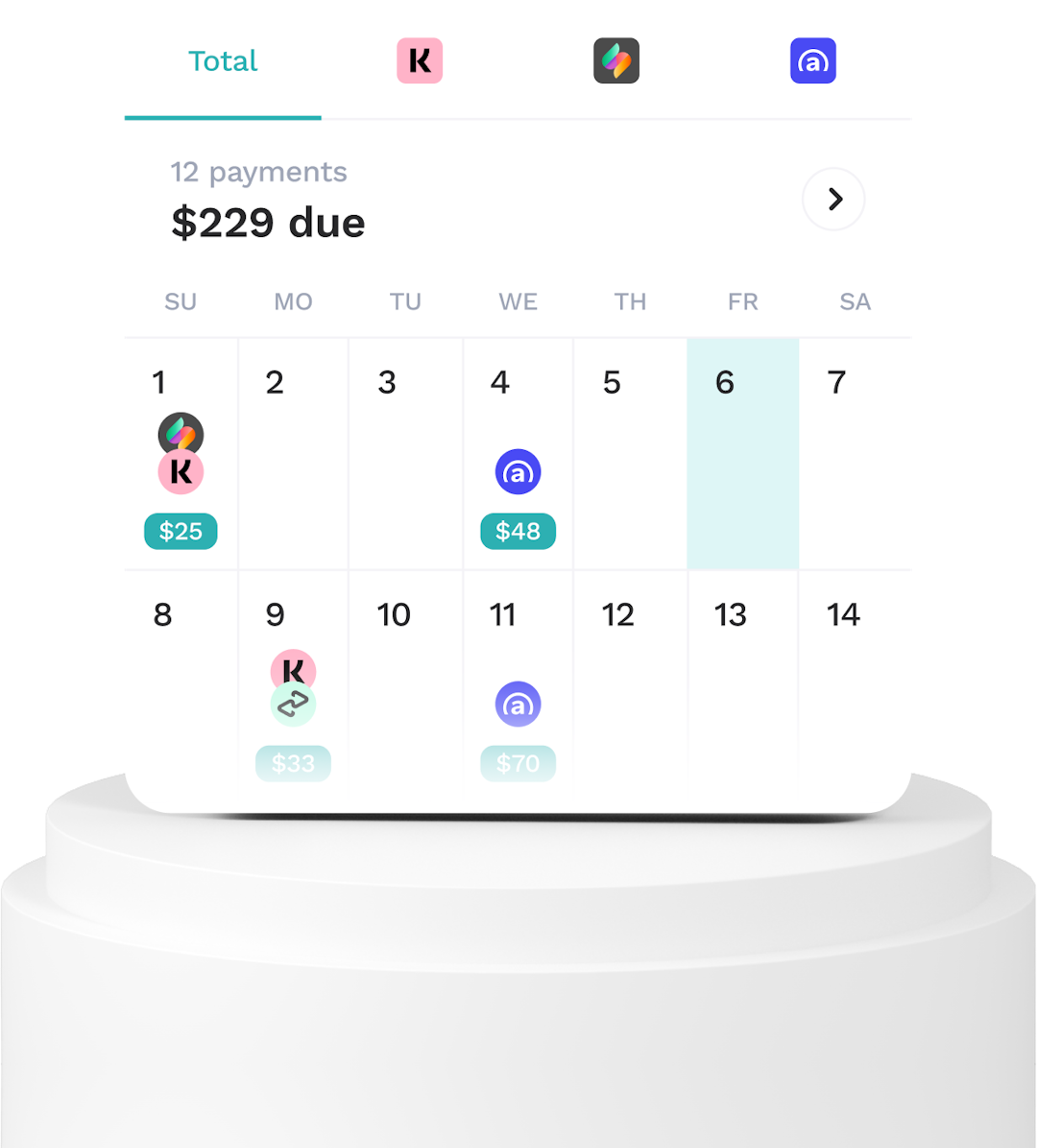

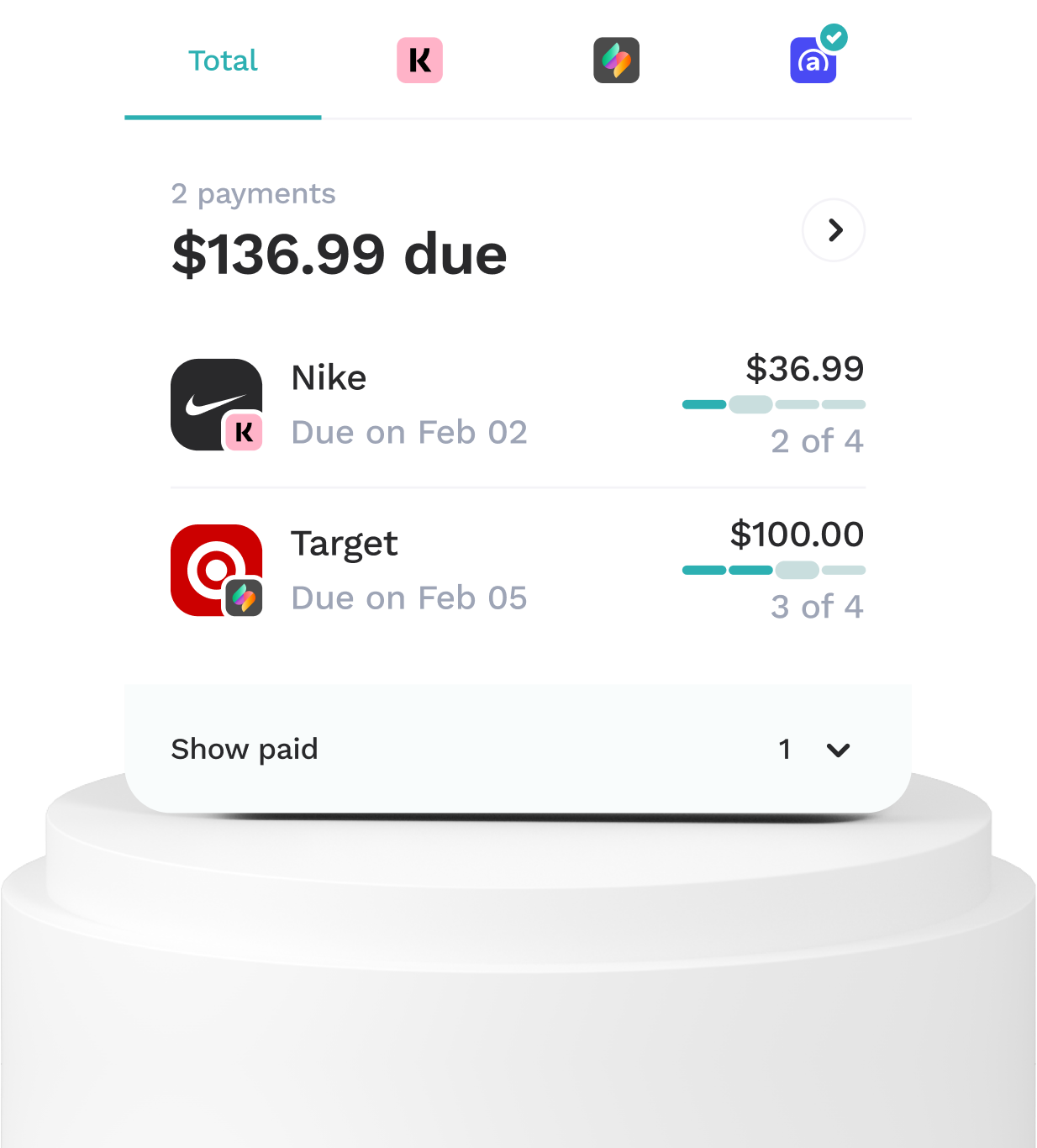

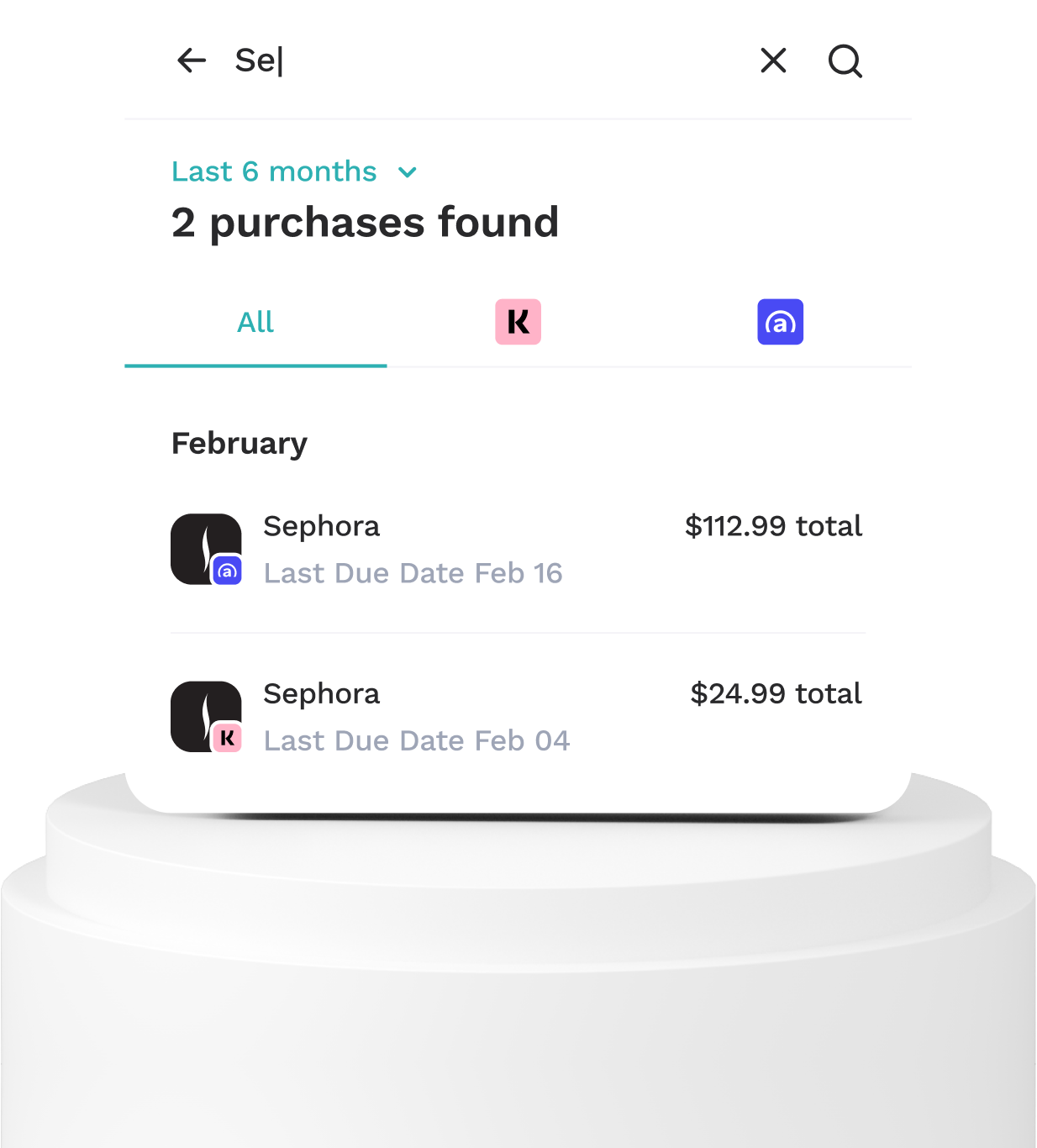

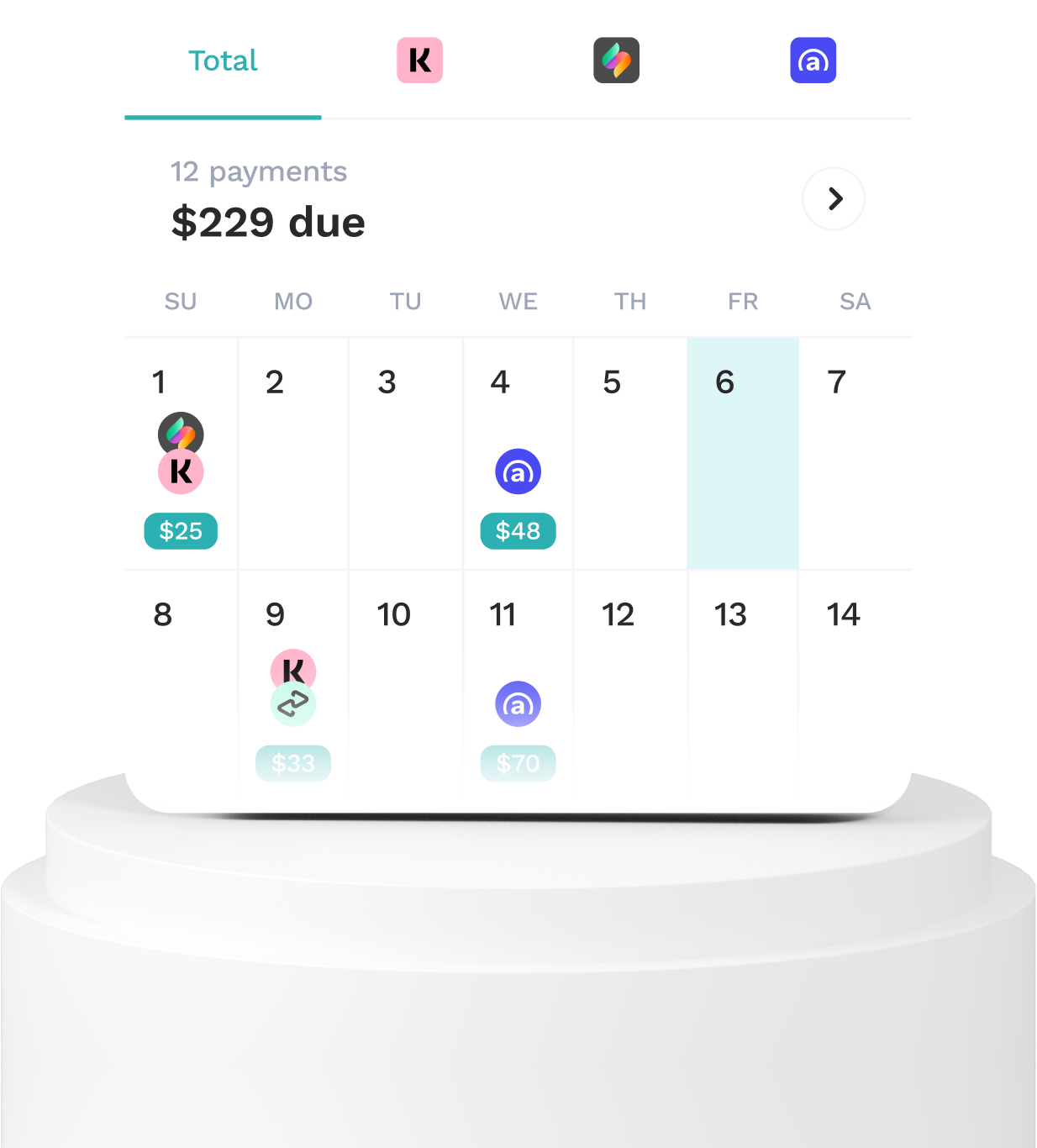

Your one-stop-shop for managing BNPL

Easily track which payments are coming up and which ones you've already paid

Your one-stop-shop for managing BNPL

Upcoming

Easily track which payments are coming up and which ones you've already paid

Overview

Insights

Search

Calendar

Our customers love us

Get the credit you deserve for payments you're already making.

Your credit profile will thank you.

Get Started